.

Beaten semi-finalists in the Champions League four years ago United have since slipped further and further away with each progressive season. Beaten in the quarter-finals in 2003, they failed to get beyond the first knock-out round in 2004 and 2005. This year they finished bottom of arguably the weakest of the eight qualifying groups. Last season they finished without a trophy of any description.

Beaten semi-finalists in the Champions League four years ago United have since slipped further and further away with each progressive season. Beaten in the quarter-finals in 2003, they failed to get beyond the first knock-out round in 2004 and 2005. This year they finished bottom of arguably the weakest of the eight qualifying groups. Last season they finished without a trophy of any description. Mini Mac-like PC which runs Windows Media Center with an Intel Celeron M 360, 512MB of memory, DVD/CD-RW combo and a 40GB hard drive for £499. Another model offers an Intel Pentium M 760 and an 80GB drive for £699. The manufacturer is AOpen of Taiwan, which showed the system earlier this year at at the Computex Taipei exhibition

Mini Mac-like PC which runs Windows Media Center with an Intel Celeron M 360, 512MB of memory, DVD/CD-RW combo and a 40GB hard drive for £499. Another model offers an Intel Pentium M 760 and an 80GB drive for £699. The manufacturer is AOpen of Taiwan, which showed the system earlier this year at at the Computex Taipei exhibition

The Atlantic Conveyor, a life-giving ocean current that keeps northern Europe warm, is slowing down, scientists said on Wednesday. If the 30 percent slowdown seen over the past 12 years is not just a blip, temperatures in northern Europe could drop significantly, despite global warming, they added.

The Atlantic Conveyor, a life-giving ocean current that keeps northern Europe warm, is slowing down, scientists said on Wednesday. If the 30 percent slowdown seen over the past 12 years is not just a blip, temperatures in northern Europe could drop significantly, despite global warming, they added. Click here for Real Estate Quarterly from Russia this PDF contains

Click here for Real Estate Quarterly from Russia this PDF contains

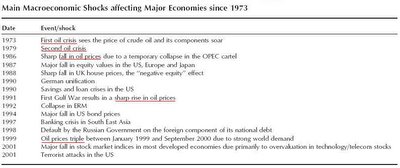

Who is Robert Shiller? Well he once famously predicted the stock market crash of 2000. He's a Professor of Economics Yale University and has drawn parallels between the irrational exuberance of the stock market in the late 1990s and the boom in international property prices in recent years.

Who is Robert Shiller? Well he once famously predicted the stock market crash of 2000. He's a Professor of Economics Yale University and has drawn parallels between the irrational exuberance of the stock market in the late 1990s and the boom in international property prices in recent years.At a meeting of senior officials from the Organisation for Economic Co-operation and Development and the Central Bank on the subject of the property market, Irish officials were informed of OECD research which suggests that Irish prices were 15 per cent overvalued. Click here for more

According to the latest edition of the permanent tsb/ESRI House Price Index the price of houses for First Time Buyers rose by 9.4% over the first nine months of this year compared to an increase of just 4.8% for second time buyers. The 'monthly standardised price' table is available here this dates back to 1996 when a 3 bed semi would set you back €69,350 compared to €263,715 in 2005. The average price paid for a house by a First Time Buyer is now just short of a quarter of a million euro – some €242,172.

According to the latest edition of the permanent tsb/ESRI House Price Index the price of houses for First Time Buyers rose by 9.4% over the first nine months of this year compared to an increase of just 4.8% for second time buyers. The 'monthly standardised price' table is available here this dates back to 1996 when a 3 bed semi would set you back €69,350 compared to €263,715 in 2005. The average price paid for a house by a First Time Buyer is now just short of a quarter of a million euro – some €242,172.This Tuesday, the Central Bank (ireland) will publish what is probably its most important report this year. The bank will unveil its financial stability report on Irish banks. It will assess whether the banks have been prudent in their lending over the course of the past year and whether there is any evidence of risk to the system.

In a former life, I used to write economic reports for the Central Bank, so am reasonably well placed to give you an idea of what it will say. To get an idea of what the read will be like, imagine you are listening to a theatrical prosecuting barrister outlining a long list of offences he alleges were committed by the defendant, ‘Mr Banks'.

“M'lud, in front of me is this snivelling piece of financial delinquency, who has been engaged in practices so heinous, so depraved, so despicable that he threatens the integrity of the entire system. His profligacy knows no bounds; his self-serving greed is so transparent as to suggest that he is beyond redemption.”

Full article is available from here

According to estimates by The Economist, the total value of residential property in developed economies rose by more than $30 trillion over the past five years, to over $70 trillion, an increase equivalent to 100% of those countries' combined GDPs. Not only does this dwarf any previous house-price boom, it is larger than the global stockmarket bubble in the late 1990s (an increase over five years of 80% of GDP) or America's stockmarket bubble in the late 1920s (55% of GDP). In other words, it looks like the biggest bubble in history. Click here for more

Paul Simons, The Times weatherman, said that the shift in temperature was influenced by a phenomonon known as North Atlantic Oscillation, or NAO, influenced by a lowpressure system over Iceland and high pressure over the warm Azores islands in the sub-tropical Atlantic. When the Icelandic pressure rises and the Azores pressure dips, Britain catches blasts of bitterly cold air.

He said: “In the 1940s the NAO turned negative and brought some of the coldest European winters of the 20th century, including the bitter freezes that helped to defeat Hitler’s invasion of Russia. Another bout of negative NAOs in the 1960s included the worst winter for more than 200 years, when homes were buried under snow and ice floes drifted in the English Channel.

“The Met Office is forecasting a negative NAO this winter. Although they cannot tell how severe the weather will be, the past ten winters had such ridiculously mild weather that even an average British winter will come as a rude shock.”

See here for more details